As experiential marketing grows, integrating payment gateways becomes essential for managing recurring events effectively. This guide provides a clear framework for decision-makers, outlining key considerations and practical steps to implement payment systems within ticketing and event platforms. The focus is on improving operations, enhancing customer interactions, gathering meaningful data, and increasing revenue in 2025, while highlighting effective solutions as current standards.

Why Payment Integration Matters for Recurring Events

Recurring events are central to brand engagement in today’s experiential marketing landscape. Unlike single events, they require robust payment systems to manage multi-session bookings, subscription models, and diverse global regulations across different markets.

Customers now expect quick, secure payment options similar to online shopping. They value fast checkouts, saved payment details, and mobile-friendly processes that work everywhere. If these needs aren’t met, brands risk losing sales and valuable customer insights.

A well-planned payment integration turns potential obstacles into strengths. Brands that adopt reliable payment systems often see fewer abandoned carts, higher sales, better data collection, and smoother operations. These systems also provide useful information on customer behavior and preferences, shaping future strategies.

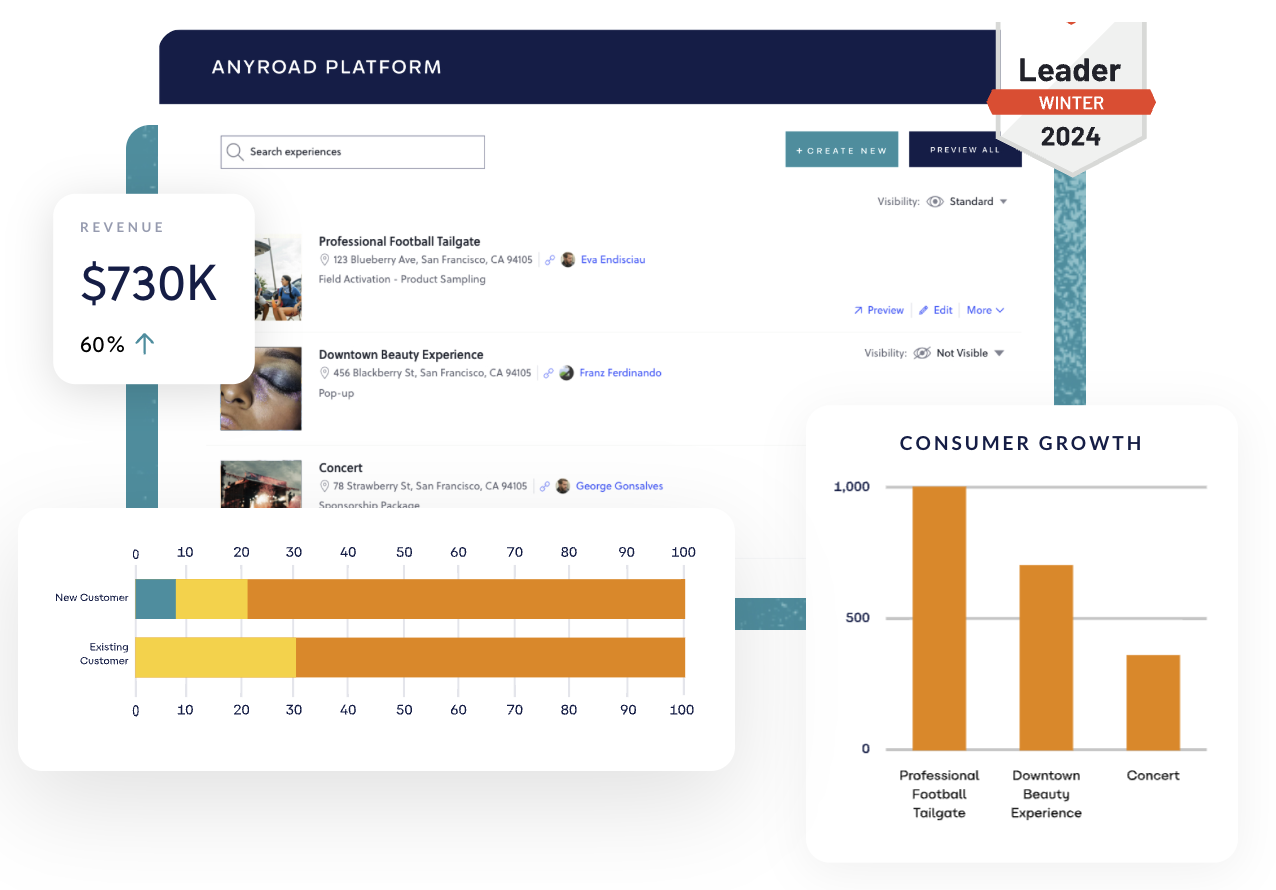

AnyRoad’s platform supports this by combining payment processing with event management. It ensures every transaction adds to a deeper understanding of customers while streamlining operations.

Want to improve your event payments and turn transactions into insights? Book a demo with AnyRoad to explore how integrated payment solutions can help with recurring events.

Breaking Down the Payment Ecosystem: Key Players and Rules

Supporting Global Payment Options for Events

Different regions and audiences have unique payment preferences, and addressing these is vital for boosting event attendance. Catering to varied methods ensures broader access and higher sales.

- Traditional Cards: Credit and debit cards like Visa, MasterCard, and Discover are vital for ticket sales worldwide, especially with region-specific options in North America and beyond. Supporting a wide range of cards is critical for recurring events with global reach.

- Digital Wallets: Options like PayPal, Apple Pay, and Google Pay offer fast, secure checkouts with features like biometric authentication, driving mobile ticket purchases. These are ideal for last-minute or impulse event bookings where speed matters.

- Local Systems: Regional payment methods can significantly lift sales in specific markets by meeting local preferences. Brands expanding globally often notice better results when they include these options.

Meeting Global Compliance Standards

Managing payment compliance across different regions is a complex but necessary task for event organizers. Staying on top of regulations protects businesses and builds customer trust.

- PCI DSS: This standard ensures secure handling of cardholder data through thorough system and policy reviews. Visa and MasterCard require compliance, with penalties for breaches at non-compliant businesses. Third-party checks verify secure processes, reinforcing trust in data protection.

- SCA and PSD2: In Europe, Strong Customer Authentication under PSD2 mandates extra verification like 3D Secure codes or biometric checks. This applies to electronic payments in the EEA and UK, with exemptions for small transactions or recurring tokenized payments. Providers need 3D Secure 2.0 for smoother authentication on mobile devices.

- Regional Rules: India requires two-factor authentication for domestic card payments and support for UPI or 3DS codes. Payment systems must adapt to various local banking protocols.

- Provider Standards: Providers need PCI DSS validation through audits to secure cardholder data with encryption and testing. PSD2 compliance includes multi-factor authentication and fraud prevention for customer safety.

Key Factors for Payment Gateway Integration in 2025

Streamlining Operations for Efficiency

For operations teams handling recurring events, integrating payment gateways shifts slow, error-filled manual tasks to automated processes. Older systems often split bookings, payments, refunds, and reporting across separate tools, creating inefficiencies that grow over time.

Unified payment solutions bring everything into one workflow. Staff can handle bookings, payments, and reconciliations without jumping between platforms or manual data entry. This is especially useful for recurring events with repeat customers, subscription billing, or complex schedules.

Automation also cuts errors in transactions, maintains consistent pricing, and offers real-time revenue tracking. For brands with multiple locations, a central system standardizes processes while allowing local adjustments for pricing or promotions.

Improving Customer Experience to Boost Sales

How customers experience payment processes affects sales and brand perception. Today’s audiences expect smooth checkouts comparable to top online stores, especially for emotional or impulse event purchases.

Mobile-friendly design is crucial, particularly with authentication needs. Many authentication steps involve app switches or SMS codes, making mobile optimization essential for compliance. Payment flows must guide customers through these steps without interruptions.

Digital wallets speed up checkouts, reduce input errors, and build trust with secure features. For recurring events, they encourage repeat bookings by simplifying the process, fostering loyalty.

Offering local payment methods also lifts sales by showing cultural awareness and removing barriers. This matters most for brands entering new markets or hosting destination events.

Capturing Data to Maximize Returns

Payment integration offers marketing teams a chance to collect valuable first-party data and measure returns. Unlike basic systems that only record transaction details, strategic setups turn every payment into a detailed customer insight.

Advanced platforms gather profiles, buying habits, and preferences, helping to tailor future campaigns. Marketers can group customers by spending or interests, linking payment data to full journey analytics for clear proof of marketing value.

This data also tracks customer history across events, identifying valuable segments, spotting dropout risks, and crafting retention plans. It shifts experiential marketing from a cost to a measurable income source.

Planning for Global Growth and Compliance

For leaders focused on expansion, choosing a payment gateway must consider both current and future needs. The system should handle growth into new regions, event types, and changing rules.

Scaling globally means supporting multiple currencies and cross-border payments while meeting local standards. Providers must manage international transactions and follow data security rules across regions. This is key for brands targeting diverse markets.

Compliance must also adapt over time. Evolving regulations require systems that update without major overhauls, avoiding high costs and complexity in multiple regions.

Build or Buy: Deciding on Resources

Choosing between custom payment solutions or existing platforms is a major decision with lasting impact. Building in-house offers control over experience and data but demands significant expertise and maintenance.

Custom systems face hidden expenses in security, compliance, fraud protection, and updates, often beyond the skills of marketing teams. Ongoing costs can pull focus from core goals.

Platforms like AnyRoad deliver ready-to-use payment features without the burden of development. They include built-in compliance, established provider connections, and strong security, freeing brands to prioritize customer experiences.

Ready to simplify payments and focus on creating great experiences? Book a demo with AnyRoad to see how integrated solutions can enhance your operations.

How AnyRoad Simplifies Payment Management

Effortless Payment Connections

AnyRoad’s platform removes technical hurdles, letting brands concentrate on crafting experiences and building relationships. It connects with major payment providers like Square and Shopify, allowing brands to keep existing setups while accessing full event management tools.

This integration covers the entire financial setup, linking accounting, CRM, and analytics systems for unified data. Payment details enhance customer profiles and support in-depth reporting.

For large organizations with unique needs, AnyRoad provides developer tools and API access. This allows tailored connections to in-house systems while keeping security and compliance intact.

Core Features for Event Marketing

- Custom Booking: AnyRoad’s white-label booking tool integrates into brand websites, keeping customers in the brand’s space during purchase and collecting detailed data throughout.

- On-Site Ease: The Front Desk app aids staff with mobile payment processing for walk-ins, group bookings, and digital waivers, meeting compliance needs efficiently.

- Detailed Data: The FullView feature captures info from every group attendee, not just the buyer, expanding customer insights and understanding group preferences.

- Strong Security: Built-in ID scanning supports age checks for compliance, especially for alcohol brands, balancing rules with smooth customer flow.

Unique Benefits

AnyRoad stands out by prioritizing brand control and first-party data over mere demand creation. Brands retain ownership of customer information and can tailor the journey. Its AI-driven feedback tool, PinPoint, turns survey responses into practical insights, linking customer opinions to operational changes.

Take charge of the guest journey and turn payments into a key asset. Request a demo with AnyRoad to learn how integrated payment management boosts experiential marketing.

Getting Ready and Avoiding Common Mistakes

Preparing Your Team for Integration

Successful payment integration goes beyond tech setup and needs full organizational effort. Start with aligning operations, marketing, finance, and IT teams, each bringing unique needs to the table.

Operations seek streamlined workflows, marketing wants data tools, finance needs accurate reporting, and IT focuses on security. Setting shared goals like better customer experiences and higher revenue per event guides the process over individual aims.

Plan resources for both setup and ongoing needs. Many overlook the effort to shift from old systems, so include staff training, process guides, and customer updates for a smooth transition.

Rolling Out in Stages

A thoughtful rollout minimizes disruption and builds on early lessons. Start with a small test on specific events or regions before full implementation.

First, focus on basic payment functions to ensure reliable transactions. This brings quick benefits and builds trust in the system. Next, add data collection and integrations to refine marketing and customer insights. Finally, expand to analytics, multiple locations, and advanced customer journey tools, leveraging gained expertise for growth.

Steering Clear of Pitfalls

A major error is viewing payments as just a technical task instead of a business opportunity. Focusing only on transactions misses chances to improve experiences and build relationships.

Overlooking global compliance is another risk. Authentication rules differ worldwide, requiring gateways that handle varied protocols. Ignoring these can lead to costly delays in new markets.

Not connecting payment data to marketing or CRM tools creates isolated information, limiting returns and relationship growth. Also, neglecting mobile design harms sales, as authentication often relies on smartphones.

Tracking Returns on Payment Integration

Measure returns by setting baseline figures before starting and tracking gains across areas. Improved sales from smoother checkouts often cover costs quickly.

Long-term value comes from better customer retention through tailored data-driven campaigns. Operational savings from less manual work and errors add up, while reduced risks from fraud and compliance issues offer hidden but real benefits.

Common Questions Answered

Which Payment Security Standards Matter Most for Event Platforms?

PCI DSS is the core standard for secure payment handling, requiring strong networks, encryption, and regular security checks. It’s essential for protecting data and maintaining trust with card networks.

For European markets, Strong Customer Authentication under PSD2 adds verification via 3D Secure 2.0, designed to work well on mobile. Beyond payments, protecting all customer data aligns with privacy laws like GDPR and CCPA for consistent security.

How Do Global Payment Rules Affect Recurring Event Sales?

Rules like SCA in Europe may seem to slow transactions with extra steps, but proper setups boost trust and cut fraud losses. Regional needs, like India’s two-factor authentication, vary widely, so systems must adapt without confusing users.

Well-executed flows with digital wallets and mobile design can increase sales by building confidence. Poor setups, however, risk losing repeat customers. Storing payment profiles for returning attendees speeds up future bookings while staying secure.

How Do I Measure Returns from Advanced Payment Integration?

Track multiple metrics like sales increases from smoother checkouts and long-term customer value from personalized campaigns. Savings from less manual work and fewer errors also count, as do reduced risks from fraud or compliance issues, protecting brand reputation.

Why Does First-Party Data Matter for Payment Systems in Recurring Events?

Collecting first-party data turns payments into a tool for deeper customer connections. It maps attendance and spending patterns, helping tailor retention plans and pricing. Linking payment info to broader profiles shows marketing impact, while predictive trends aid in planning resources and schedules.

Conclusion: Turning Payments into a Growth Tool for Events

Payment gateway integration is more than a technical step; it’s a way to drive growth, ensure compliance, and build loyalty for recurring events. Brands that see payments as part of customer relationships will lead in experiential marketing.

Handling global rules from PCI DSS to local protocols requires flexible systems for consistent experiences across markets. Benefits include better operations, enhanced interactions, richer data, and clear returns on investment.

AnyRoad’s platform ties payment processing to event management and data collection, embedding it within a system built for engagement and efficiency.

Investing in advanced payment systems shows a focus on customers and lasting connections. Brands that use payments to strengthen ties and gain insights will stand out.

Ready to turn payments into a strategic advantage? Schedule a demo with AnyRoad today to see how full payment integration supports experiential marketing success.