Save 5 Minutes

You’re busy, we’re busy. We get it. So here’s ‘Pick Your Battles: When to Dig In on Event Strategy or Move On”’ in four sentences or less:

You enter your strategy crossroads armed and informed when you identify early success indicators and warning signs like:

- Positive and negative feedback

- Attendee engagement trends (or lack thereof)

- Foot traffic, for better or worse.

Dig Deeper

Sometimes, marketing is easy. Most of the time, though, it’s a slog through numbers, strategy, and execution. When your team is on overdrive, it’s easy to get blinders on and wait for more information before you make a move.

Next thing you know, it’s been 6 months, and your experiential strategy is still stagnating. So, what’s a busy brand leader to do? You have a decision to make: do you keep trying or do you re-direct to a new direction?

In this blog, we’ll start the tough conversation you’ve been hoping you won’t have:

The pivot point.

If you’re not seeing success in your strategy, it’s time to move on, no matter how much you love the idea. We hate to say it, but Allen Ginsberg was right — you have to kill your darlings.

When your events aren’t performing, and you don’t pivot your strategy, you’re likely spending money on events that will keep seeing lower returns or negatively impact loyalty and brand perception. But hey, it’s the devil you know, right?

From identifying early indicators to warning signs, this is a guide to thinking through your next steps and ensuring that you find event success through data-driven decisions.

Identifying Early Event Success Indicators

Nothing’s more exciting than seeing your investments pay off; well, maybe winning the lottery, but that’s a close second.

Early indicators that you’re getting your in-person events right can be uncovered by analyzing past events and your current event calendar It’s getting access to those indicators that some team leaders struggle with.

Weaving in opportunities to collect data throughout your event lifecycle and following up on each experience with post-event surveys are two of the many ways you can surface those early success signs.

What Are Early Indicators in My Event Strategy?

There are several metrics you can start tracking to help quantify event performance.

Event success indicators can look like:

- Positive feedback and high NPS

- Increased engagement metrics

- Rising attendance rates and ticket sales

Knowing you’re on the right track with your event strategy will make it easy to know when you need to pivot. Analyzing performance after every event is vital because a larger sample size will reveal patterns and trends that can help your planning process and even mid-execution changes.

That way, you’re making your budget and bandwidth count towards a greater impact on brand awareness, loyalty, and revenue — you name it.

Positive Feedback From Your Target Audience

Experiences bring in all kinds of attendees, but the secret to success is narrowing your scope. Tracking sentiment helps you understand the reality of who’s coming to your event, engaging with your brand, and noting your patterns.

Whether you’re using online registration, ticket sales, or capturing attendees’ information onsite, you want to open the door for your audience to give you as much information as they feel comfortable with.

Hearing from the event attendees themselves gives you a direct line into understanding who your consumers are, what they care about, and what they think of your brand. After all, if your attendee’s experience isn’t resonating, that’s a clear sign to return to the drawing board.

Most events selling tickets use registration systems that make sending out a post-experience survey easy. Onsite, you can use QR codes that lead to a form attendees can fill out and show your booth workers for special gifts.

“But AnyRoad blog writer,” you say. “I’m running way too many events to read all the responses!”

When you reach the point that your events calendar is jam-packed with brand experiences or your team is hosting events across the globe, artificial intelligence can be a huge ace up your sleeve when it comes to analyzing your data. Using AI to surface themes and patterns in consumer feedback will give you a direction and an early idea of where your strategy should go next.

Increased Attendee Engagement Metrics

There are a thousand ways to define engagement, from social media interactions to marketing opt-ins; even digital marketing gets to join the party.

When we say engagement, we’re talking about touch points that your consumer:

- Clicks on

- Posts about

- Searches Google for

- Opens or forwards

- Purchases add-ons or limited items from the event

- Responds to like surveys

- Engaging with your event website or homepage

Tracking and transparency throughout different teams are essential for a full lay of the land. Each person you work with has a data collection process that covers different areas.

Full coverage is cross-functional.

Increased engagement means that your consumers are having a conversation with you; they want to join your community and get to know you better. And during your next event, you can double down on where your consumers engage most.

Some of the teams you want to bring together are:

- Digital

- Social

- Community and Loyalty Programs

- Brand

- PR

- Advertising

When these teams collaborate, you have multiple avenues to promote your event and understand your strategy’s current state from every angle. Maybe they also have great ideas for how they can best support.

Rising Attendee Rates

Like a snowball that turns into an avalanche, increased attendance rates are a big early indicator of success. 44% of the experience industry measures their success in foot traffic since it’s a quick sign that their event strategy is working. (We’ve got our own thoughts about that, though.)

When you’re tracking multiple events, knowing the most successful locations, event types, and who’s attending is just as important as the number of consumers. To collect data worldwide is a team effort, with you sitting at the helm. After all, events are just one piece of your larger strategy, right?

The more people who get to experience your brand’s curated sense of place, the more opportunities you have to collect valuable insights from your customers. H aving a line of sight into what’s happening across the board is important, and knowing why the attendee rates are rising comes from consistent measurement.

Consider when your teams collect data and how to get these early indicators. When you know what percentage of foot traffic your target audience is, you can officially say, “Yes, this is working” in a foundational way.

What’s Important About Recognizing My Indicators?

Think back on your last frustrating brainstorm. Maybe it was a presentation; maybe it was a fire drill meeting. You know that one person who said ‘no’ to all of your obviously brilliant ideas, but didn’t have any suggestions?

Yeah, we don’t like them either.

Which is why you need an understanding of your success. How will you make a decision to continue investing, improve, or stop if you only focus on what’s not working?

Success metrics act as context for your larger brand strategy. You can pivot more specifically and know where doubling down on your investment makes sense. Share event results and consumer insights with cross-functional teams to connect the dots; we promise it’s worth it.

When your many events are all siloed, it can be hard to get the full picture of your success and contributions to the top-level goals of your brand.

Warning Signs You’re Focusing On The Wrong Things

We all wish there were a red flashing light when an event strategy goes south, a stop sign, a ‘Do Not Pass Go’ that lets you know when something isn’t working.

Automating your emergency stop is possible with the right tools and ongoing analysis of event performance. As a brand leader, it’s time to learn the downward trends and black holes that are waving a red flag up high, just like what went right.

What Are Warning Sign Examples?

Some warning signs are obvious; some, not so much. Looking for lower numbers than expected is obvious; you wouldn’t be a brand leader without knowing the basics. But it can be tougher to see what’s not there, as opposed to clear negative results.

Examples of warning signs include:

- Declining attendance rate or ticket sales

- Little audience engagement

- Negative feedback and reviews

Declining Attendance Rates

That’s right, we’re back at attendance rates. And why not? Foot traffic is the easiest and fastest way to measure success.

The clearest warning sign you can get is seeing a slowdown in ticket sales on your event website, compounded by a lack of of last-minute push.

There’s a lot to learn from understanding how far in advance people tend to book their tickets and the days and times they happen most frequently.

Globally, your attendance rates will fluctuate for different reasons that might not apply to your teams in other countries. Successful event planning relies on understanding the time, place, and market landscape in addition to your target audience.

Maybe it’s not time to dig into Japan during Golden Week, or the European market is seeing high inflation rates. When you watch for these warning signs, it’s time to move on and position your focus on another country or tactic.

Lack of Audience Engagement

Yes, we’re doing opposites in this blog. But ‘lack’ is a bit different from ‘downturn.’

Lack of audience engagement means lower numbers than predicted, or maybe even no numbers at all. Social media analytics aren’t seeing anyone interacting or posting about the events; people aren’t opening emails despite opting-in previously.

Your target audience’s silence is one of the best data sources you can have. This can go even deeper than an event; this might be a sign that it’s time for some check-ins with your consumer insights team. It’s possible that you need to refresh your consumer profiles.

Alternatively, your attendees aren’t being prompted to engage. To figure out which way the wind blows, think about how your teams are collecting data. What touch points aren’t working, and could you pivot towards more event data based on your successes?

Negative Event Feedback and Reviews

Another red flag that’s deceptive; in fact, surfacing negative reviews can be harder for a larger brand. Overseeing your department at large means you rely on others to bring you what’s wrong; most of the time, the dots aren’t already connected.

Getting actionable insights doesn’t work when your disparate teams aren’t feeding their results into the same place. Aggregation is one thing, but finding patterns is another. Market by market or agency by agency, when you lack a centralized view of your insights, so-so reviews aren’t as obvious.

Again, tech is vital here. We no longer have to rely on a thousand monkeys typing on a thousand keyboards to understand what works at large.

Your teams are collecting valuable insights, and funneling them into an easy-to-understand dashboard will save you hours of your precious time trying to understand where that wind is blowing.

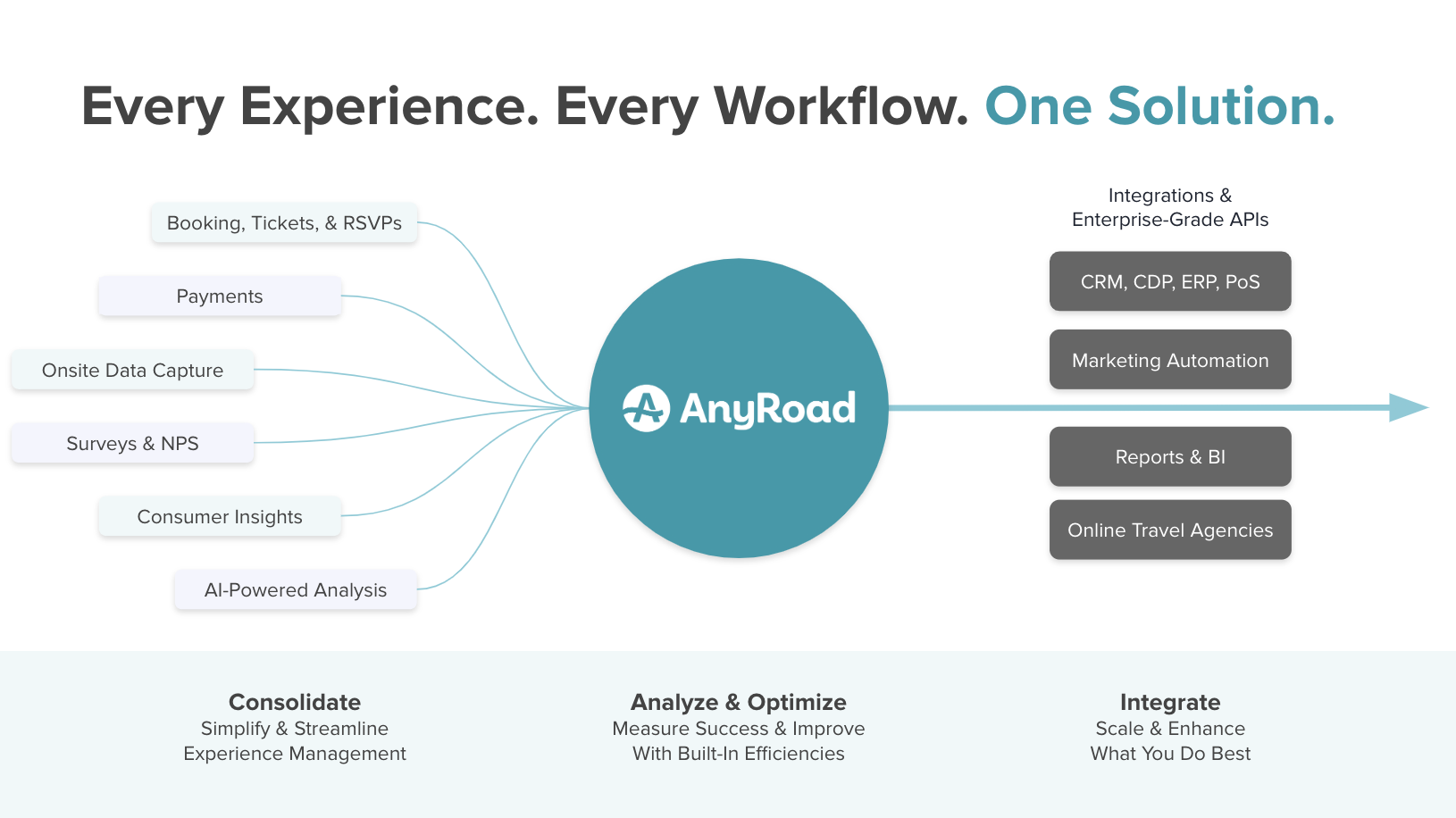

Experiential marketing platforms and tools are made exactly for this reason; one view with many event details is the way forward for many brand leaders and global heads.

You might need to move on from an event in one city but invest more in another. Understanding the differences between an event strategy and a target audience problem is the difference between success and wasted expense.

Why Is It Important Not To Ignore Warning Signs?

Part of the marketing mindset is to wait and watch to gather as much information as possible before pivoting. And that’s not a bad thing; statistically speaking, the more event data you have, the more accurate your decision-making is.

But when you ignore early warning signs, a delay in making adjustments might actually hurt your brand.

Ignoring early warning signs puts you at risk for unmet goals, wasted money, and delivering experiences that don’t resonate with your consumers and negatively impact brand perception.

As a brand leader, making sure your events leave a lasting positive impression and align with your brand values is vital for growth and increased revenue. A direct line of sight can be a blessing, especially when you see your teams going off course.

POPLIFE: Collect Data and Move Forward

In 2023, an artisanal mezcal brand collaborated with experiential agency POPLIFE to develop and execute a best-in-class festival platform to introduce consumers to the wonderful world of mezcal.

With AnyRoad’s platform, POPLIFE and their mezcal client gained a new understanding of consumers, which could be used to:

- Drive distribution decisions

- Tailor marketing efforts

- Optimize future brand experiences

Additionally, with a significant increase in opted-in contacts, the alcohol brand will be able to continue growing brand awareness and building long-term relationships with its target consumers.

%20(7).png)

The Takeaway

Digging in or moving on: it’s always going to be a tough call. But tracking and surfacing a balance of positive and negative indicators will absolutely help make decisions more confidently.

Early indicators and warning signs are like the sound of your race car as you’re taking laps. You have to make a high-pressure decision, and when you know your car, you know when it’s time to continue or make a pit stop.

Decisions backed by quantifiable results make everyone happy. Knowing you’re not grasping around in the dark for the light switch brings with it a sense of security.

You already know how important metrics are in the long run; now, you can use them to change out the engines mid-flight to redirect your course when needed.

.png)

%204.50.48%E2%80%AFp.m..png)

%2012.57.51%E2%80%AFa.m..png)